MAHINDRA MANULIFE LOW DURATION FUND

(An open ended low duration debt scheme investing in instruments such that the Macaulay duration of the Portfolio is between 6 months and 12 months (please refer to page no. 34 of SID). A relatively low interest rate risk and moderate credit risk.)

|

|

|

|

|

| Data as on 31st, December 2023 | ||||

| Investment Objective | The investment objective of the Scheme is to provide reasonable returns, commensurate with a low to moderate level of risk and high degree of liquidity, through a portfolio constituted of money market and debt instruments. However, there is no assurance that the investment objective of the Scheme will be realized and the Scheme does not assure or guarantee any returns. |

| Fund Features | Positioned between liquid funds and short-duration funds with respect to the risk-return matrix. Potentially better returns than that of liquid funds through strategic shifts in the maturity profile. Lower volatility through relatively lower duration than short duration Higher flexibility in asset allocation vis-à-vis liquid funds.. |

| Fund Manager and Experience | Fund Manager: Mr. Rahul Pal Total Experience: 22 years Experience in managing this fund: 6 years and 11 month (managing since February 15, 2017) |

| Date of allotment | February 15, 2017 |

| Benchmark | CRISIL Low Duration Debt B-I Index |

| Available Plans for subscription by investors | Direct (Default) and Regular |

| Available Options under each plan | Growth (Default) and IDCW |

| Available Facilities under IDCW Option | IDCW Reinvestment (Daily (Default), Weekly, Monthly), IDCW Payout (Monthly) |

| Minimum Application Amount | Rs. 1,000/- and in multiples of Re. 1/- thereafter |

| Minimum Additional Purchase Amount | Rs. 1,000/- and in multiples of Re. 1/- thereafter |

| Minimum Redemption / Switch-outs Amount: | Rs.1,000/- or 1 unit or account balance, whichever is lower |

| SIP | Minimum Weekly & Monthly SIP Amount: Rs 500 and in

multiples of Re 1 thereafter Minimum Weekly & Monthly SIP Installments: 6 Minimum Quarterly SIP Amount: Rs 1,500 and in multiples of Re 1 thereafter Minimum Quarterly SIP installments: 4 |

| Monthly AAUM as on December 31, 2023 (Rs. in Cr.): | 508.79 |

| Quarterly AAUM as on December 31, 2023 (Rs. in Cr.): | 480.76 |

| Monthly AUM as on December 31, 2023 (Rs. in Cr.): | 491.51 |

| Total Expense Ratio2 as on December 31, 2023: | Regular Plan: 1.09% Direct Plan: 0.30% 2Includes additional expenses charged in terms of Regulation 52(6A)(b) of SEBI (Mutual Funds) Regulations, 1996 and Goods and Service Tax. |

| Load Structure: | Entry Load: N.A. Exit Load: Nil |

| Annualised Portfolio YTM*1: | 7.97% |

| Macaulay Duration: | 324.22 days |

| Modified Duration1: | 0.84 |

| Residual Maturity: | 488.73 days |

| As on (Date) | December 31, 2023 |

| *In case of semi annual YTM, it will be annualised 1Yield to maturity should not be construed as minimum return offered by the Scheme. |

|

| NAV/Unit | Regular Plan (In Rs.) |

Direct Plan (In Rs.) |

| Daily IDCW |

1000.0001 |

1113.0835 |

| Monthly IDCW |

1113.5149 |

1133.0045 |

| Weekly IDCW | 1053.8463 |

1031.5680 |

| Growth | 1469.0845 |

1557.1993 |

| IDCW: Income Distribution cum Capital Withdrawal | ||

Issuer |

Rating |

% of Net Assets |

|

|---|---|---|---|

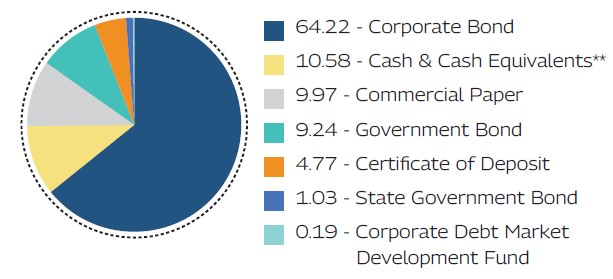

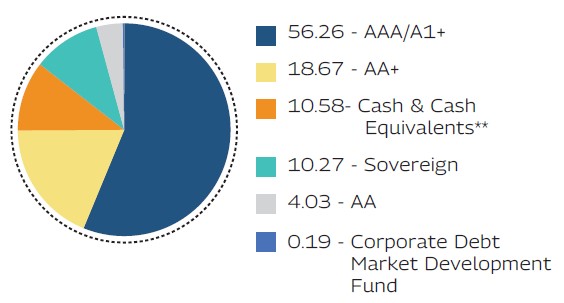

| Certificate of Deposit | 4.77% |

||

| ICICI Bank Limited | ICRA A1+ |

2.87% |

|

| Axis Bank Limited | CRISIL A1+ |

1.90% |

|

| Commercial Paper | 9.97% |

||

| 360 One Prime Limited | CRISIL A1+ |

4.00% |

|

| Nuvama Wealth Finance Limited | CRISIL A1+ |

3.01% |

|

| Piramal Capital & Housing Finance Limited | CRISIL A1+ |

1.96% |

|

| Piramal Enterprises Limited | CRISIL A1+ |

1.00% |

|

| Corporate Bond | 64.22% |

||

| REC Limited | CRISIL AAA |

6.08% |

|

| TATA Realty & Infrastructure Limited | ICRA AA+ |

6.05% |

|

| Embassy Office Parks REIT | CRISIL AAA |

6.04% |

|

| LIC Housing Finance Limited | CRISIL AAA |

5.22% |

|

| Shriram Finance Limited | CRISIL AA+ |

5.11% |

|

| Bharti Telecom Limited | CRISIL AA+ |

5.08% |

|

| Small Industries Dev Bank of India | CRISIL AAA / ICRA AAA |

5.06% |

|

| Export Import Bank of India | CRISIL AAA |

4.95% |

|

| Godrej Industries Limited | CRISIL AA |

4.03% |

|

| National Bank For Agriculture and Rural Development | CRISIL AAA / ICRA AAA |

4.03% |

|

| National Housing Bank | CRISIL AAA |

3.04% |

|

| Cholamandalam Investment and Finance Company Ltd | ICRA AA+ |

2.43% |

|

| Power Finance Corporation Limited | CRISIL AAA |

2.04% |

|

| Mindspace Business Parks REIT | CRISIL AAA |

2.03% |

|

| Bajaj Housing Finance Limited | CRISIL AAA |

2.01% |

|

| Power Grid Corporation of India Limited | CRISIL AAA |

1.02% |

|

| Corporate Debt Market Development Fund | 0.19% |

||

| Corporate Debt Market Development Fund Class A2 | 0.19% |

||

| Government Bond | 9.24% |

||

| 4.7% GOI FRB (MD 22/09/2033) | SOV |

4.13% |

|

| 6.99% GOI (MD 17/04/2026) | SOV |

3.05% |

|

| 7.37% GOI (MD 23/10/2028) | SOV |

2.06% |

|

| State Government Bond | 1.03% |

||

| 8.16% Maharastra SDL (23/09/2025) | SOV |

1.03% |

|

| Cash & Other Receivables | 10.58% |

||

| Grand Total | 100.00% |

||

| ( |

|||

| Mahindra Manulife Low Duration Fund | CAGR Returns (%) |

Value of Investment of Rs. 10,000* |

NAV / Index Value (as on December 29, 2023) |

||||||

| Managed by Mr. Rahul Pal | 1 Year |

3 Years |

5 Years |

Since Inception |

1 Year |

3 Years |

5 Years |

Since Inception |

|

| Regular Plan - Growth Option | 6.69 |

4.51 |

5.55 |

5.76 |

10,667 |

11,411 |

13,097 |

14,691 |

1,469.0845 |

| Direct Plan - Growth Option | 7.52 |

5.34 |

6.40 |

6.66 |

10,750 |

11,686 |

13,632 |

15,572 |

1,557.1993 |

| CRISIL Low Duration Debt B-I Index^ | 7.65 |

5.63 |

6.32 |

6.54 |

10,763 |

11,783 |

13,584 |

15,456 |

7,195.38 |

| CRISIL 1 Year T-Bill Index^^ | 6.95 |

4.84 |

5.59 |

5.80 |

10,694 |

11,521 |

13,123 |

14,731 |

6,970.96 |

^Benchmark ^^Additional Benchmark. CAGR – Compounded Annual Growth Rate. Inception/Allotment date: 15-Feb-17. Past performance may or may not be sustained in future and should not be used as a basis of comparison with other investments. Since inception returns of the scheme is calculated on face value of Rs. 1,000 invested at inception. The performance details provided above are of Growth Option under Regular and Direct Plan. Different Plans i.e Regular Plan and Direct Plan under the scheme has different expense structure. *Based on standard investment of Rs. 10,000 made at the beginning of the relevant period. For performance details of other schemes managed by the Fund Manager(s), please click here | Best Viewed in Landscape mode

| Mahindra Manulife Low Duration Fund | Regular Plan |

Direct Plan |

CRISIL Low Duration Fund BI Index^ |

Crisil 1 Yr T-Bill Index^^ |

|||||

| SIP Investment Period | Total Amount Invested (  ) ) |

Market Value (  ) ) |

CAGR Returns (%) |

Market Value (  ) ) |

CAGR Returns (%) |

Market Value (  ) ) |

CAGR Returns (%) |

Market Value (  ) ) |

CAGR Returns (%) |

| 1 Year | 120,000 |

124,220 |

6.65 |

124,736 |

7.48 |

124,794 |

7.57 |

124,488 |

7.08 |

| 3 Years | 360,000 |

390,219 |

5.33 |

395,056 |

6.15 |

396,588 |

6.41 |

392,097 |

5.65 |

| 5 Years | 600,000 |

682,802 |

5.13 |

697,293 |

5.96 |

699,768 |

6.10 |

685,882 |

5.30 |

| Since Inception | 820,000 |

988,744 |

5.41 |

1,018,737 |

6.27 |

1,019,648 |

6.29 |

993,577 |

5.55 |

^Benchmark ^^Additional Benchmark. CAGR – Compounded Annual Growth Rate. Inception/Allotment date: 15-Feb-17. Past performance may or may not be sustained in future and should not be used as a basis of comparison with other investments. Returns greater than 1 year period are compounded annualized. For SIP returns, monthly investment of equal amounts invested on the 1st business day of every month has been considered. CAGR Returns (%) are computed after accounting for the cash flow by using the XIRR method (investment internal rate of return). For SIP Performance please click here | Best Viewed in Landscape mode

**Cash & Cash Equivalents includes Fixed Deposits, Cash & Current Assets and TREPS

**Cash & Cash Equivalents includes Fixed Deposits, Cash & Current Assets and TREPS

Record Date |

Plan(s)/Option(s) |

Individuals/HUF (IDCW) |

Others (IDCW) |

Face Value |

Cum-IDCW NAV |

(Rs. per unit) |

(Rs. per unit) |

(Rs. per unit) |

(Rs. per unit) |

||

27-Oct-23 |

Monthly Regular IDCW |

4.6712 |

4.6712 |

1000 |

1452.5741 |

27-Oct-23 |

Monthly Direct IDCW |

5.5092 |

5.5092 |

1000 |

1137.7282 |

28-Nov-23 |

Monthly Regular IDCW |

5.9591 |

5.9591 |

1000 |

1118.7535 |

28-Nov-23 |

Monthly Direct IDCW |

6.8746 |

6.8746 |

1000 |

1139.0936 |

27-Dec-23 |

Monthly Regular IDCW |

5.9325 |

5.9325 |

1000 |

1118.7269 |

| 27-Dec-23 | Monthly Direct IDCW |

6.7691 |

6.7691 |

1000 |

1136.1112 |

Pursuant to payment of IDCW, the NAV of the IDCW Option(s) of the Scheme/Plan(s) falls to the extent of payout and statutory levy, if any. Past performance may or may not be sustained in future and should not be used as a basis for comparison with other investments. For complete list of IDCWs, visit www.mahindramanulife.com. |

|||||

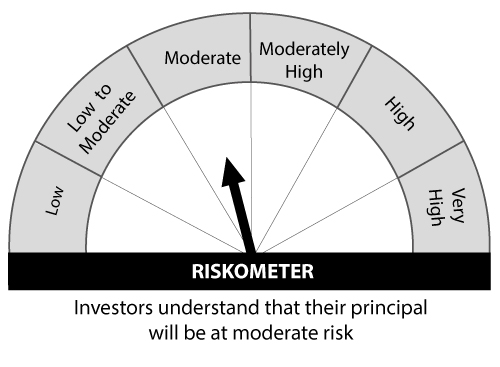

Product Suitability |

|

| This Product is Suitable for investors who are seeking* | |

|

|

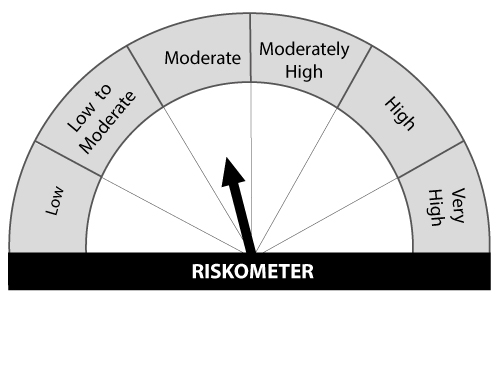

Scheme Riskometers |

Benchmark Riskometers |

|

Scheme Benchmark: CRISIL Low Duration Debt B-I Index |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them. |

|

| Refere to the PRCM disclosure click here | |